Beware of little expenses; a small leak will sink a great ship

Financial statements are the backbone of any business analysis. They offer a snapshot of a company’s financial health, performance, and potential. As you may recall from our article on Understanding the business, financial reporting typically includes four main statements: the Income Statement, Cash Flow Statement, Balance Sheet, and Statement of Changes in Equity.

In this mini-series, we’ll build the essential knowledge to navigate these reports and understand how an investor should interpret them. Today, we begin with the income statement. Often called the Profit and Loss (P&L) statement, it’s a powerful tool that tells the story of a company’s financial performance over a specific period.

Think of it as a report card for a business. The income statement reveals how profitable the company was over a period of time, tracing the journey from total sales down to the final “bottom line” profit. For investors, managers, and creditors, understanding this journey is crucial for making informed decisions. It answers the fundamental question: Is this company making money?

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

The Purpose of the Income Statement

Think of the income statement as a company's financial story for a period (a quarter or a year). The plot is:

We brought in this much money (Turnover or Revenue).

It cost us this much to make our product (COGS or- Cost of Goods Sold), leaving us with this much (Gross Profit).

Then, we spent this much on running the company (Operating Expenses).

After paying interest and taxes, here is what was left for the owners (Net Income).

To see how this works, let's look at a simplified example for a fictional company, "Apex Innovations":

Apex Innovations - Income Statement | |

Turnover or Revenue (Sales) | $1,000,000 |

– Cost of Goods Sold (COGS): raw material, salaries and wages for employees who work directly on producing the goods or providing the service (e.g. factory workers, machine operators, and cooks in a restaurant), etc. | -$400,000 |

Gross Profit | $600,000 |

– Operating Expenses: Rent, Admin, Utilities, salaries for employees in non-producing departments (e.g. administrative, marketing, sales, or HR departments) | -400,000 |

Operating Profit (EBIT) | $200,000 |

– Financial Costs: Interest Expense, Bank Fees | -$20,000 |

Pre-Tax Income | $180,000 |

-Taxes | -$45,000 |

Net Income | $135,000 |

In essence, the purpose of the income statement is to transform raw financial data into a clear, structured narrative about a company's operational success or failure. It answers several key questions:

How much revenue did the company generate?

What did it cost to produce and sell those goods or services?

How much profit (or loss) did it make after covering all expenses?

Beyond pure profit measurement, the income statement also provides insight into operational efficiency, cost management, and financial discipline. For analysts and investors, trends in margins, operating expenses, and interest costs often provide early clues about strategic shifts or risks.

What does a YAINer look for:

When assessing historical results we start right at the top of the income statement with Revenues. Revenue is the total value of goods and services sold in a specific period. As a rule of thumb, for the YAINers, annual revenue growth should be at least 5%. A quick look at the chart showing the revenue trend over the past years is more informative than a thousand words and if often sufficient to determine whether a company is worth further investigation or not.

Have a look at the following charts for:

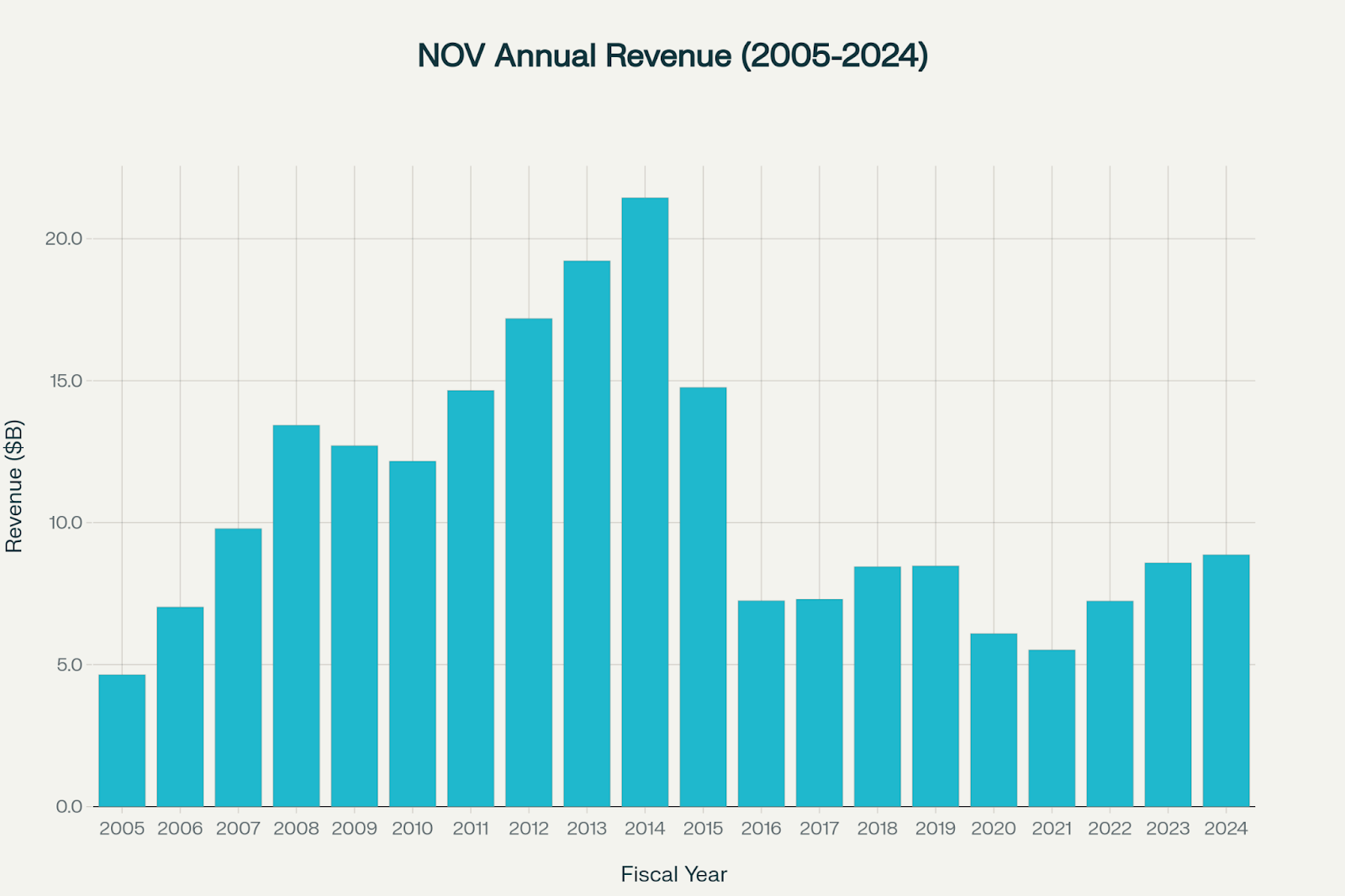

National Oilwell Varco Annual Revenue for the Last 20 Fiscal Years

You can immediately see that National Oilwell Varco — $NOV ( ▲ 2.26% ) is a volatile, cyclical company with an unstable revenue trend. Companies with such volatile results are not suitable for a YAIN long-term strategy and are difficult to value. Making money with this kind of company largely depends on market timing.

The next chart shows a different picture for:

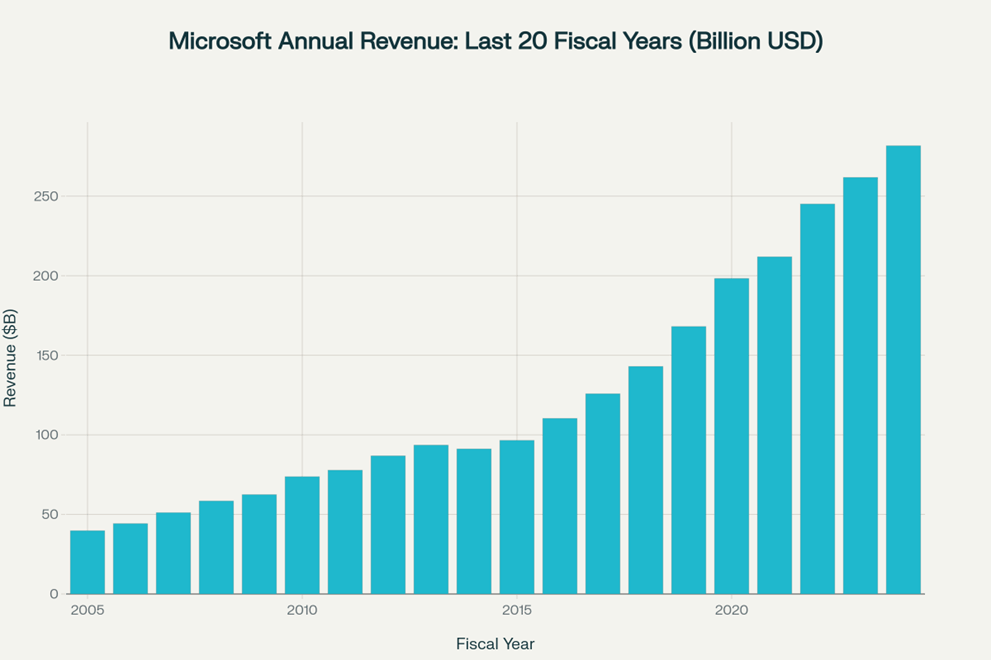

Microsoft Annual Revenue for the Last 20 Fiscal Years

The type of revenue trend above from Microsoft — $MSFT ( ▲ 2.4% ) illustrates steady, profitable growth without dramatic swings. This clearly highlights a good starting point for further analysis.

Once you've identified a healthy revenue trend, the next step is to dissect what's driving it. The quality of this growth is key. Did it come from:

Selling More: Gaining market share or entering new markets?

Innovation: The successful launch of new products?

Pricing Power: Simply raising prices without losing customers?

External Factors: Favorable currency movements or a major acquisition?

As a YAINer, you should favor growth driven by operational excellence (selling more, pricing power) over growth fueled by one-off events like large acquisitions."

Beyond Revenues: Profitability

While the starting point of the analysis is revenue and revenue growth, it is perhaps unsurprising that these metrics alone aren’t sufficient for a YAINer. We want more. The same requirements we had for revenues apply to profit. Profit is the positive result of a company in a specific period after deducting all expenses and costs from the income. We are only interested in profitable companies. Profit growth is the positive percentage difference in profit between two periods. Ideally, profit growth should outpace revenue growth. This could indicate scale benefits or pricing power. If certain costs remain constant while revenue grows, more profit is retained.

There are different types of profit, each offering unique insights:

Gross Profit – revenue minus direct production costs.

Operating Profit (EBIT) – gross profit minus operating costs such as rent, wages, depreciation, R&D, and marketing.

Net Profit – what remains after deducting interest and taxes.

For investors, this final figure is often divided by the number of shares to calculate Earnings Per Share (EPS), a key valuation metric.

Which profit should a YAINer look at?

So, which profit is best for analysis? Gross profit only tells you about the product's profitability, not the efficiency of the overall business. Net profit is influenced by debt levels (interest) and tax jurisdictions, making it difficult to compare the core operations of two different companies.

For this reason, when analyzing a company’s operational profitability, we focus on EBIT. By using EBIT, we compare companies based on their core business activities, ensuring an apples-to-apples comparison.

You’ve probably heard of the profit margin—it’s the ratio of profit to revenue. We focus on the EBIT margin, also known as the operating margin. We can calculate this by dividing EBIT by revenue:

EBIT margin % = EBIT / Revenue x 100

If a company has an EBIT of $10 million on revenue of $100 million, its EBIT margin is 10%.

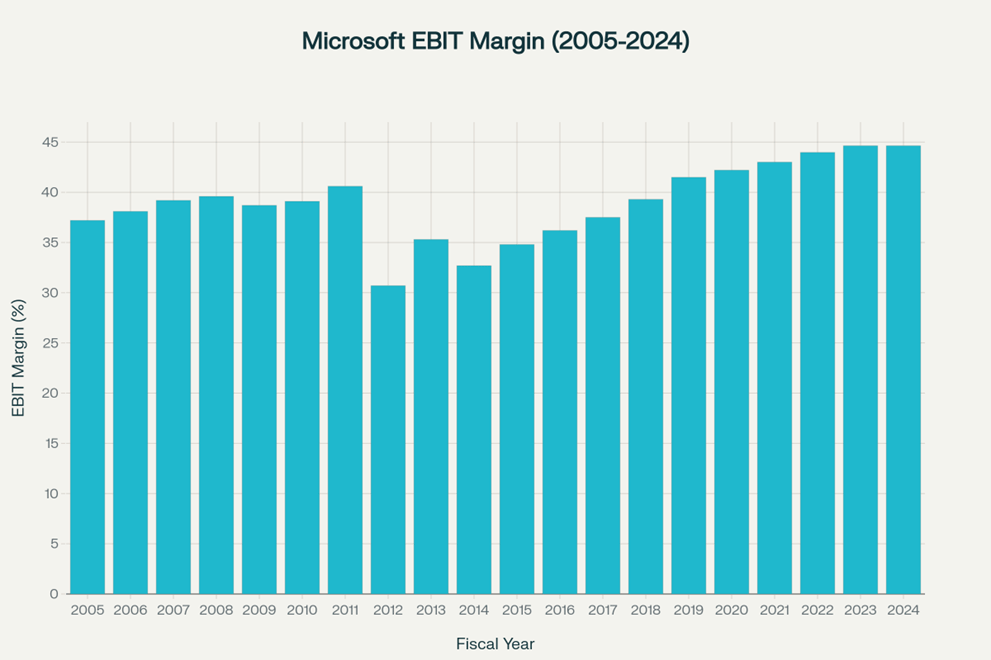

Microsoft EBIT margin for the past 20 years.

A rising margin is a great sign of efficiency as more profit is being extracted from the revenue. However, it's crucial to compare this margin to the company's own history and to its industry peers. A company with a 15% EBIT margin might seem strong, but if its main competitors average 25%, it could indicate a weaker competitive position.

Increasing margins are desirable, but always in combination with revenue growth. If revenue stagnates while profit continues to grow, you should realize that profit growth will eventually halt, as cost-cutting cannot continue indefinitely.

More Than Just Numbers

The income statement is a fundamental document that provides a clear and comprehensive overview of a company's financial performance. It bridges the gap between the revenue generated and the actual profit earned, detailing every cost along the way.

By understanding its components—from revenue and COGS to operating expenses and net income—you can move beyond the headlines and truly assess a company's health. When combined with analysis techniques like calculating profit margins and comparing results over time, the income statement transforms from a simple accounting report into an indispensable tool for any savvy investor or business leader.

However… Show Me the Cash!

As the saying goes: “Profit is an opinion, cash is a fact.” The value of a company is determined by the future cash flows it will generate, not its accounting profits. This is what we will address next week in our letter on the Cash Flow Statement.