Diversification is protection against ignorance. It makes little sense if you know what you are doing.

Finding the "Magic Number" between Diworsification and Ruin

When we start investing, we are drilled with one golden rule above all others: Diversify.

It is the only "free lunch" in finance, they tell us. Don't look for the needle in the haystack; buy the haystack. Spread your risk. Never expose yourself to a single point of failure.

So, the diligent investor builds a portfolio. They buy a tech stock. Then a bank. Then a utility. Then, feeling "exposed," they add a pharma giant, a consumer staple, maybe a REIT. Before they know it, they own 45 stocks. They feel responsible. They feel safe.

But are they?

At YAIN, we believe that for the active stock picker, excessive diversification is not a shield; it is a sword that cuts both ways. It protects you from volatility, yes, but it also severs your connection to outperformance. It dilutes your best ideas with your mediocre ones.

Today, we are going to answer the oldest question in portfolio management: How many stocks are enough?

The answer lies at the uncomfortable intersection of Math (what reduces risk) and Psychology (what lets you sleep).

Homeowners: Don’t miss winter insurance savings

EverQuote is designed to make your seasonal insurance refresh effortless.

Fast Process: Skip repetitive forms and get matched in minutes.

More Ways to Save: Compare rates from both national and local carriers.

Winter-Ready Coverage: Enter the holidays with clarity and confidence.

And for homeowners, the benefits can go even further. Many qualify for lower auto insurance rates, and reviewing your options now can lead to real savings before winter weather peaks. With EverQuote, checking those potential savings takes only moments.

Whether you’re hauling gifts, driving through snow, or gearing up for the new year, now is the perfect time to ensure your coverage keeps you protected—and your holiday budget comfortable.

The Math: Where the Curve Flattens

Let’s start with the cold, hard numbers. Modern Portfolio Theory (MPT) distinguishes between two types of risk:

Systematic Risk (Market Risk): The risk that the entire market collapses (e.g., a recession, a pandemic). You cannot diversify this away. If the S&P 500 drops 30%, your stocks will likely drop too.

Unsystematic Risk (Idiosyncratic Risk): The risk that a specific company fails (e.g., a scandal at Wirecard or a failed drug trial). This can be diversified away.

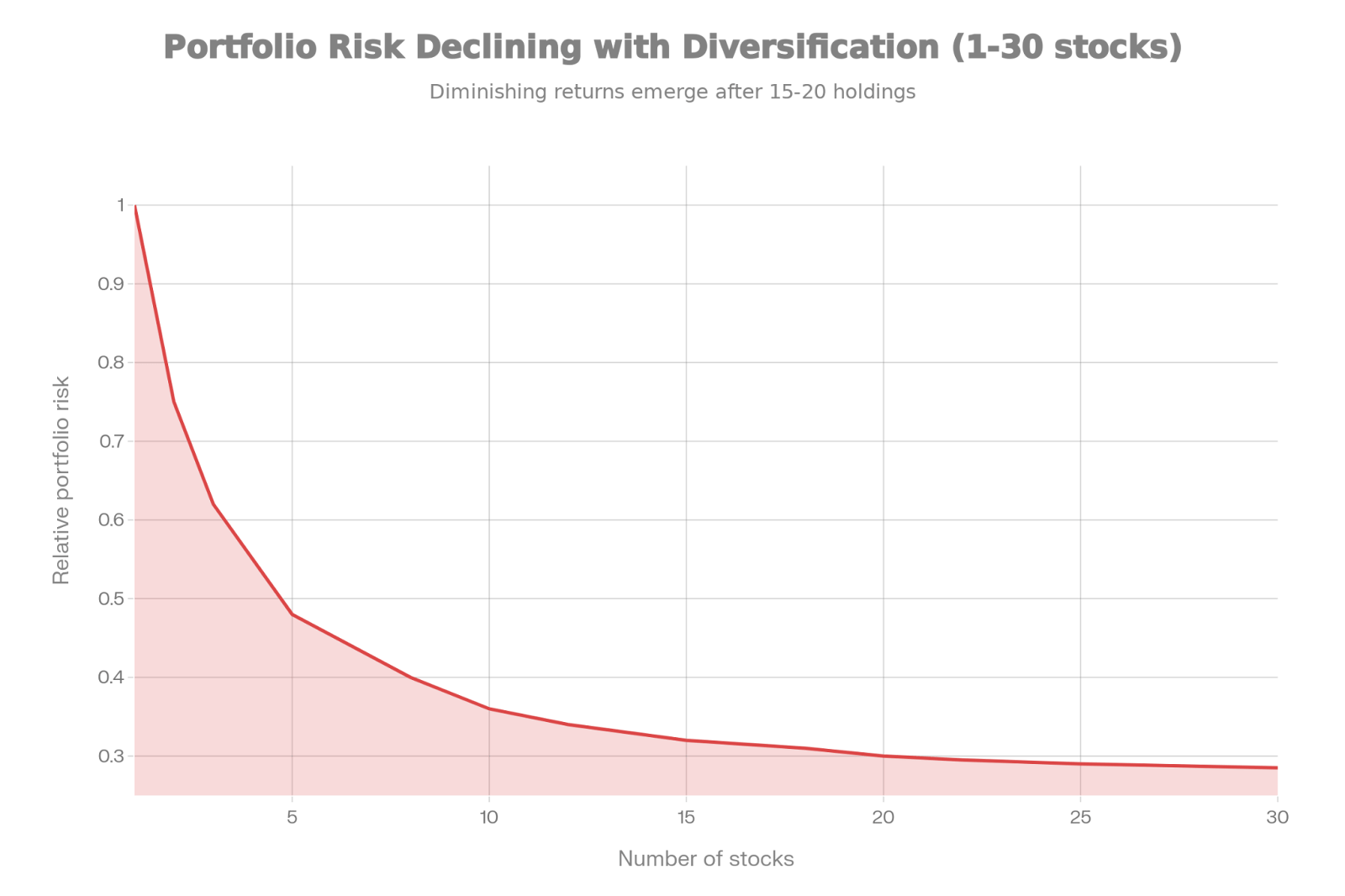

But how many stocks do you actually need to eliminate that second type of risk? The academic goalposts have shifted over time, creating confusion for retail investors.

The Classic View (10-15 Stocks): In 1968, researchers Evans & Archer published a landmark study showing that you could eliminate roughly 90% of unsystematic risk with just 10 to 15 stocks. For decades, this was the gospel. It validated the "focused portfolio" approach.

The Modern View (50+ Stocks): More recently, proponents of passive investing—most notably Burton Malkiel (author of A Random Walk Down Wall Street) and Campbell et al. (2001)—have argued that the world has changed. They found that individual stocks have become more volatile than they were in the 1960s. Their conclusion? To achieve that same level of safety today, you need 50 or more stocks.

The YAIN Reality: Malkiel is right if your goal is to perfectly mimic the index with zero deviation. If you want to be a passive vehicle, buy 50 stocks (or better yet, buy an ETF and go to the beach).

But as active investors, we are not trying to eliminate every ounce of volatility. We are trying to generate returns superior to the market. By holding 50 stocks, you are statistically guaranteed to reap the average result of those 50 companies. You have diversified away the risk, but you have also diversified away the Alpha.

Once you hold 12 to 18 uncorrelated stocks, you have hit the point of diminishing returns. Adding a 19th stock reduces your risk profile by a fraction of a percent, but it actively dilutes the impact of your best ideas.

Picture 1. Illustrative diversification curve: portfolio risk declines quickly with the first 10–15 stocks, then flattens beyond 20 holdings.

The "Diworsification" Trap

Peter Lynch, the legendary manager of the Magellan Fund, coined the term "Diworsification."

It happens when you add an investment to your portfolio not because it is a great opportunity, but because you feel you "should" own something in that sector, or simply to lower your concentration.

Think about it logically. You spend weeks researching your #1 Idea. You know the management, the margins, the moat. You have high conviction. You do real work on Ideas #2 through #10 as well.

But what about your #35 Idea? Do you know it as well as #1? Is the potential return as high? Likely not. By moving capital from Idea #1 to Idea #35 in the name of "safety," you are actively moving money from your highest conviction asset to your lowest conviction asset.

You are selling the winner to buy the mediocre.

As Charlie Munger famously said:

"I can't imagine a group of people more diluted than those who have 50 or 70 positions. If you have 3 or 4 businesses that you understand and they are dominant, why would you want to put money in your 20th best idea?"

For the individual investor (that’s us), we don't have the constraints of a Mutual Fund. We don't have to own the market. We have the luxury of saying "No."

The "Dunbar's Number" of Investing

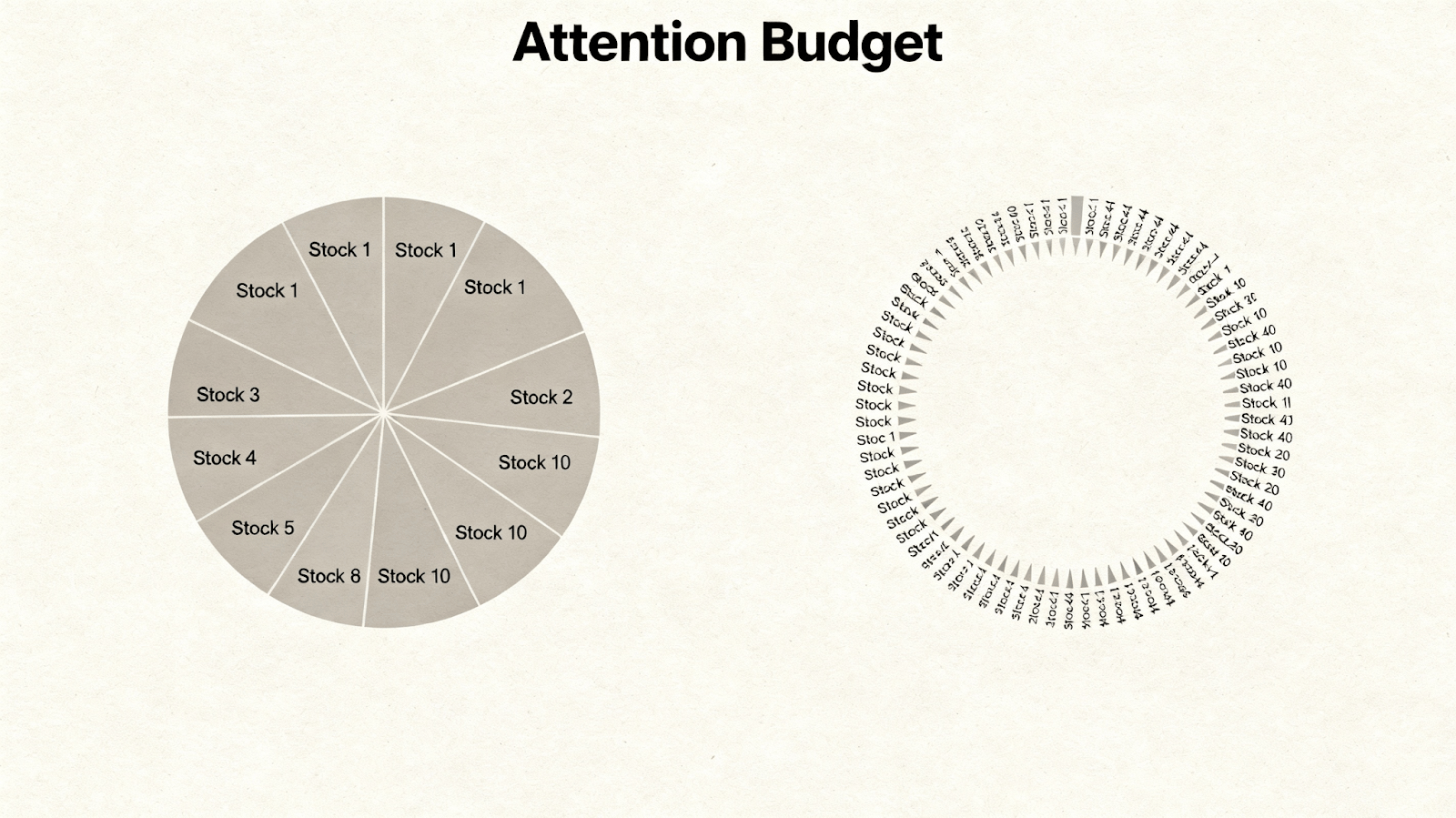

There is a cognitive constraint to diversification that models ignore: Attention.

You can only truly "know" a limited number of companies. To be a YAIN-style "Quality Owner," you need to:

Read the Annual Report.

Listen to 4 Quarterly Earnings calls.

Monitor news and competitors.

Update your valuation model.

How many companies can you do this for while having a full-time job and a life? Is it 50? Impossible. Is it 30? unlikely. Is it 10-15? Yes.

Picture 2. Your attention is finite. Your ticker list should respect that.

When you own 50 stocks, you stop being an investor and start being a collector. You stop reading the reports. You rely on headlines. When a stock drops 15%, you don't know if it's a buying opportunity or a thesis break, because you haven't done the work. Ignorance is a risk factor that diversification cannot fix.

The Sweet Spot: The YAIN Portfolio Structure

So, what is the optimal number?

For the dedicated fundamental investor, we believe the sweet spot is 10 to 20 stocks.

Here is why this range works:

1. The Position Sizing (5% to 10%)

With 10-20 stocks, your average position size is between 5% and 10%.

If a stock doubles (100% gain): A 5% position becomes 10%. You feel the impact on your net worth. It matters.

If a stock goes to zero (100% loss): You lose 5% of your portfolio. It is painful, but it is not fatal. You live to fight another day.

This offers the perfect balance: Enough concentration to generate Alpha, enough diversification to survive a disaster.

2. The Mental Bandwidth

Following 15 companies is manageable. You can read every earnings transcript. You can actually understand what you own. This depth of knowledge provides psychological armor during bear markets, preventing you from panic-selling.

3. The Sector Spread

With 15 slots, you can easily cover the major drivers of the economy without overlapping.

2 Digital Payments / Fintech

2 Luxury / Consumer Brands

2 Healthcare / Pharma

2 Industrial / Semi-cap

2 Software / Tech giants

1-2 Specials (Energy/Commodities)

You are diversified by business model, not just by ticker count.

Know Thyself: The Two Archetypes

The "right" number ultimately depends on your goal. Are you trying to Get Rich or Stay Rich?

The Accumulator (Wealth Creation)

Strategy: Concentration. Number of Stocks: 5 to 10. If you have a smaller portfolio and a long time horizon, you need meaningful compounding. You need your winners to move the needle. You accept higher volatility for higher potential returns.

Warning: You must know what you are doing. If you concentrate in 5 mediocre companies, you will go broke fast.

The Preserver (Wealth Protection)

Strategy: Diversification. Number of Stocks: 20 to 30 (or ETFs). If you have already won the game, stop playing so hard. Your goal is to not lose purchasing power.

YAIN Tip: If you want broad diversification, don't pick 50 stocks. You will fail to beat the index. Just buy the Index ETF for 80% of your portfolio, and keep a "Fun Bucket" of 5-10 stocks for your intellectual curiosity. This is the "Barbell Strategy."

The "Punch Card" Discipline

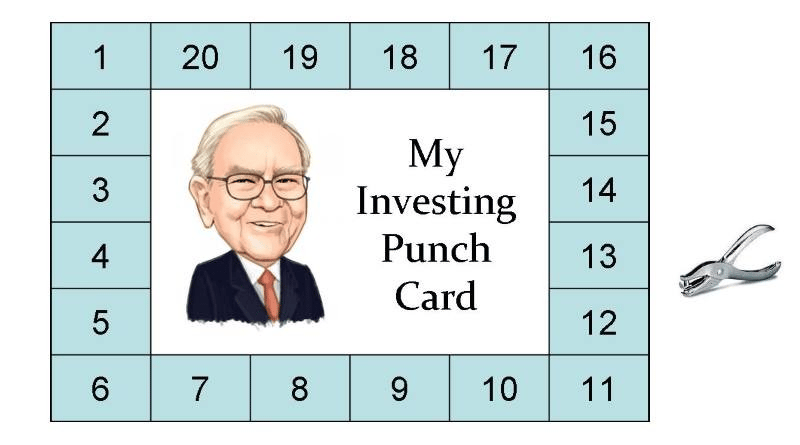

Warren Buffett famously told students that they would be better investors if they were given a punch card with only 20 slots for their entire lifetime. Every time they bought a stock, they punched a hole. When the 20 slots were gone, they could never buy another stock.

This thought experiment forces extreme patience and extreme conviction.

If you knew you could only buy 20 stocks in your life, would you have bought that speculative EV SPAC in 2021? Would you have chased that "turnaround" story that never turned around?

Probably not. You would have waited for the fat pitch—the LVMH, the Microsoft, the Schneider Electric.

You don't need a lifetime punch card, but try a Portfolio Punch Card:

Limit yourself to 15 slots.

If you want to buy a new stock, you must sell one of your existing 15.

This "One-In-One-Out" rule is the most powerful discipline tool you can use. It forces you to compare the new idea against your current roster. "Is this new idea better than my worst current idea?" If the answer is no, you don't buy. Simple as that.

Less is More

Investing is one of the few fields where working harder (buying more stocks, trading more often) often leads to worse results.

Complexity is the enemy of execution. A portfolio of 40 stocks is a garden full of weeds. You can't water the flowers because you are too busy trying to identify what is growing in the corner.

Prune your portfolio. Look at your holdings today.

Rank them from 1 to N based on your conviction and expected return.

Look at the bottom 20%. Why do you own them?

Are they there to "hedge"? Are they there because you "forgot" to sell?

If they are not compounding, cut them. Reallocate that capital to your top 5 ideas—the ones you actually believe in.

Don't aim for a portfolio that looks like a mutual fund. Aim for a portfolio that looks like a collection of businesses you would be proud to own for ten years.

12 to 18. That’s enough.