Know what you own, and know why you own it.

It is a scenario every retail investor faces eventually. You have done your research, bought shares in a promising company, and are happily holding your position. Then, on a random Tuesday, your phone buzzes.

It’s an email from your broker. The subject line is an unintelligible string of jargon: “NOTICE OF VOLUNTARY CA EVENT: RIGHTS ISSUE / SUBSCRIPTION OFFER.”

Your heart sinks. Is the company going bankrupt? Do you owe money? Is this a scam?

If you have ever felt that momentary panic, you are not alone. These notifications are regarding Corporate Actions, and while they are often drafted in dense legalese, they are a standard part of the investment lifecycle. More importantly, understanding them is crucial to protecting your wealth and avoiding accidental losses.

At YAIN, we believe in demystifying the markets. In this guide, we will break down exactly what corporate actions are, the different types you will encounter, and a step-by-step playbook on how to handle them when they land in your inbox.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

What is a Corporate Action?

In the simplest terms, a corporate action is an event initiated by a public company that brings actual change to the securities (stocks or bonds) issued by that company.

Think of it this way: buying a stock isn't just buying a digital lottery ticket; it is buying partial ownership in a living, breathing business. Businesses change. They merge, they split, they pay out profits, and they ask for more money. When the Board of Directors approves a change that affects the shareholders, it triggers a corporate action.

These actions impact your portfolio in one of two ways:

Financial Impact: They change the value of your holding or result in a cash flow (e.g., dividends).

Structural Impact: They change the number of shares you own or the identity of the company (e.g., stock splits or mergers).

The Decision Matrix: Mandatory vs. Voluntary

Before diving into the specific types of events, you must understand the "hierarchy of participation." When that email hits your inbox, the first thing you need to determine is: Do I actually have to do anything?

Corporate actions generally fall into three buckets, as illustrated below.

Mandatory Actions

These are events where you have no choice. The company has made a decision, and it applies to all shareholders equally.

Your Role: Passive observer.

Examples: Plain cash dividends, stock splits, spinoffs, mergers (once approved).

Outcome: You will just see your account balance or share count change automatically on the effective date.

Mandatory Actions with Options

These are mandatory events where the action will happen, but you can choose how you receive the benefit.

Your Role: You must make a selection by a deadline, or a "default" option will be chosen for you.

Examples: Dividends where you can choose between cash or more stock (Scrip Dividends).

Voluntary Actions

These are offers made by the company that you can accept or reject. If you do nothing, your position remains unchanged (though its value might be affected by market forces).

Your Role: Active decision-maker. You must instruct your broker if you want to participate.

Examples: Rights issues, tender offers, open offers.

The "Big Three": Actions You Will See Most Often

While there are dozens of obscure corporate actions, 90% of what you receive will fall into three categories. Understanding these is essential for portfolio maintenance.

Dividends (Cash and Stock)

This is the most common and generally the most welcome corporate action. It is the company sharing its profits with you.

Cash Dividend: The company deposits cash directly into your brokerage account.

Stock Dividend: Instead of cash, the company gives you additional shares.

DRIP (Dividend Reinvestment Plan): Some brokers or companies allow you to automatically reinvest your cash dividends to buy more shares, compounding your growth.

Tip: Always check if a dividend is a "Return of Capital." While regular dividends are taxed as income, a return of capital lowers your cost basis and is generally not taxed until you sell the stock.

Stock Splits and Reverse Splits

Companies often want their stock price to look attractive. A stock split is like cutting a pizza into more slices; you don't have more pizza, just smaller pieces.

Forward Split (e.g., 2-for-1): If you own 100 shares at €100 each, and the company does a 2-for-1 split, you will suddenly own 200 shares at €50 each. The total value of your investment ($10,000) remains exactly the same.

Reverse Split (e.g., 1-for-10): This is often a red flag. If a stock price crashes to €0.50, the company might combine shares to boost the price to €5.00 to avoid being delisted from the stock exchange.

Rights Issues (The Dilution Trap)

This is the one that causes the most confusion and potential loss for beginners.

In a Rights Issue, a company needs to raise money. Instead of going to a bank, they ask their current shareholders for cash. They offer you the "Right" to buy new shares at a discounted price.

You have three choices here:

Exercise the Rights: You pay the cash and buy the cheap shares. You maintain your percentage ownership of the company.

Sell the Rights: If the rights are "renounceable," they have their own market value. You can sell them on the market for cash.

Do Nothing ( The "Lapse"): This is usually the worst option. If you ignore the email, the rights expire worthless. The company issues the new shares anyway, and your slice of the pie gets smaller (dilution), but you get no compensation for it.

The Timeline: Anatomy of a Date

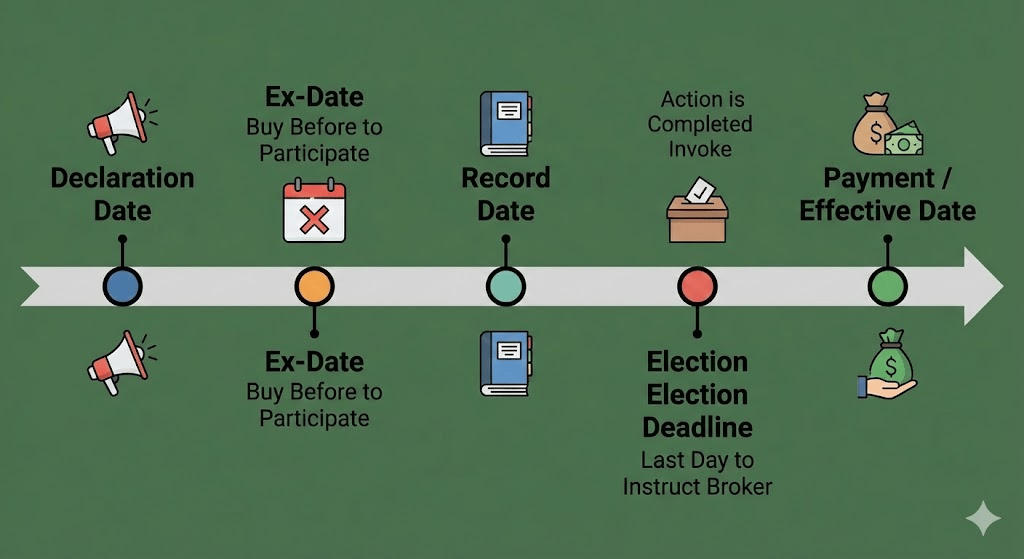

To manage corporate actions, you must understand the calendar. Brokers operate on strict deadlines. Missing a date by 24 hours can cost you money. The following timeline illustrates the key dates in a typical corporate action lifecycle.

Declaration Date

The day the Board of Directors announces the corporate action. They will state the terms (e.g., "We will pay a dividend of €0.50").

The Ex-Date (The Most Important Date)

This is the cut-off point. "Ex" means "without."

If you buy the stock before the Ex-Date, you get the corporate action (the dividend).

If you buy the stock on or after the Ex-Date, you do not get the dividend; the previous owner keeps it.

Note: The stock price usually drops by the amount of the dividend on the morning of the Ex-Date.

Record Date

This is usually 1 business day after the Ex-Date. It is the day the company checks its ledger to see who technically owns the shares. Because stock trades take time to settle (T+1 or T+2), the Ex-Date is set before the Record Date to account for this lag.

Election Deadline

For voluntary actions, this is the absolute last moment you can tell your broker your decision. Warning: Your broker’s deadline will be earlier than the company’s official deadline because the broker needs time to process your request. Always adhere to your broker's specific deadline.

Payment/Effective Date

The day the cash hits your account or the new shares appear in your portfolio.

Advanced Actions: M&A and Spinoffs

As companies mature, they often buy competitors or split themselves up.

Mergers and Acquisitions (M&A)

When Company A buys Company B, several things can happen to Company B shareholders:

All-Cash Deal: Your shares disappear, and cash appears in your account at the buyout price.

Stock-for-Stock: Your shares in Company B are converted into shares of Company A at a specific ratio.

Spinoffs

This occurs when a large conglomerate decides a specific division would perform better as an independent company.

Example: When Ferrari was spun off from Fiat Chrysler.

Result: You keep your shares in the parent company, and you suddenly find new shares of the independent company in your portfolio. These are generally tax-free events (depending on your jurisdiction) and are often value-creating.

A Practical Playbook: How to Handle the "Inbox Panic"

So, you have received the notification. Here is your step-by-step workflow for dealing with it.

Step 1: Verify the Source

Ensure the email is genuinely from your broker. Phishing scams often mimic corporate action notices to get you to click malicious links. Log in to your broker's app or website directly; do not click the email link. Go to the "Messages" or "Corporate Actions" center.

Step 2: Identify the Type

Is it Mandatory or Voluntary?

If Mandatory (e.g., a simple dividend), you can archive the email. You are done.

If Voluntary (or Mandatory with Options), proceed to Step 3.

Step 3: Read the Term Sheet

Your broker will provide a PDF or a summary text explaining the offer. Look for:

The Ratio: How many new shares can I buy for every share I own?

The Price: What is the subscription price compared to the current market price?

The Deadline: When does the broker need my answer?

Step 4: The Calculation (For Rights Issues)

If you are asked to put up more money, calculate if it is worth it. Use the TERP (Theoretical Ex-Rights Price) formula.

TERP = [(Existing Shares x Current Price) + (New Shares x Subscription Price)] / (Total Shares After Issue)

If you believe the company has a strong future, exercising the rights (buying the stock) prevents your ownership from being diluted. If you don't want to invest more cash, check if you can sell the rights.

Step 5: Check Your Liquidity

If you decide to participate in a Rights Issue or a Tender Offer, you usually need "Settled Cash" in your account. If you accept the offer but don't have the cash available on the payment date, your broker may reject your election or charge you overdraft fees.

Step 6: Make the Election

Go to your broker's corporate action tab and select your option.

Option 1: Take Cash.

Option 2: Take Stock.

Option 3: Exercise Rights.

Take a screenshot of your confirmation screen. Broker errors are rare, but having proof that you elected to take stock instead of cash can be a lifesaver if a mistake occurs.

The "Default" Trap

What happens if you are on vacation, unplugged from the grid, and you miss a deadline?

Every voluntary corporate action has a Default Option. This is the action the broker will take if they hear nothing from you.

For Dividends: The default is almost always Cash.

For Rights Issues: The default is almost always Lapse (do nothing).

Warning: The default for Rights Issues is dangerous. As mentioned earlier, if you let rights lapse, you lose the opportunity to buy cheap stock and you lose the value of selling the rights. You essentially set money on fire. If you know you will be away from your portfolio for weeks, check for upcoming dates beforehand.

A Note on Taxes

Disclaimer: YAIN does not provide tax advice. Tax laws vary wildly between EU member states, the UK, and the US.

However, generally speaking, corporate actions trigger tax events:

Dividends: Usually taxed as income in the year received.

Stock Splits: Usually not a taxable event (it just changes your cost basis per share).

Mergers (Cash): Treated as if you sold the stock. Capital Gains Tax applies.

Mergers (Stock): Often allow for tax deferral until you sell the new stock.

Always download your broker's "Annual Tax Report" or "Consolidated 1099" (if dealing with US stocks) to see how these actions were classified.

Conclusion

Corporate actions are the pulse of the market. They are the mechanism by which companies grow, restructure, and reward their owners. While the notifications can look intimidating, filled with dense text and urgent deadlines, they are simply questions asked of you as a business owner.

By understanding the difference between a Mandatory and a Voluntary action, and keeping an eye on the Ex-Date, you transform from a passive speculator into an active, informed shareholder.

Next time your phone buzzes with a "NOTICE OF EVENT," don't panic. Open the email, identify the opportunity, and make the choice that serves your strategy.