You think it's a bit odd that when the narrative is 'demand for compute is infinite', the sellers keep subsidizing the buyers?

By the time Nvidia reported its record-breaking $57 billion in quarterly revenue yesterday, the numbers had already ceased to be the story. We know the demand is there. We know the chips are selling. The question that kept institutional investors awake in New York and London last night was not "How much?" but "From whom?"

As we approach the end of 2025, the technology sector has bifurcated into two distinct realities. On the surface, we have the "Infrastructure Supercycle"—a relentless, capital-intensive buildout of data centers, nuclear power plants, and GPU clusters that rivals the industrial mobilization of the post-war era. Beneath the surface, however, lies a financial mechanism that looks increasingly like an Ouroboros: a snake eating its own tail.

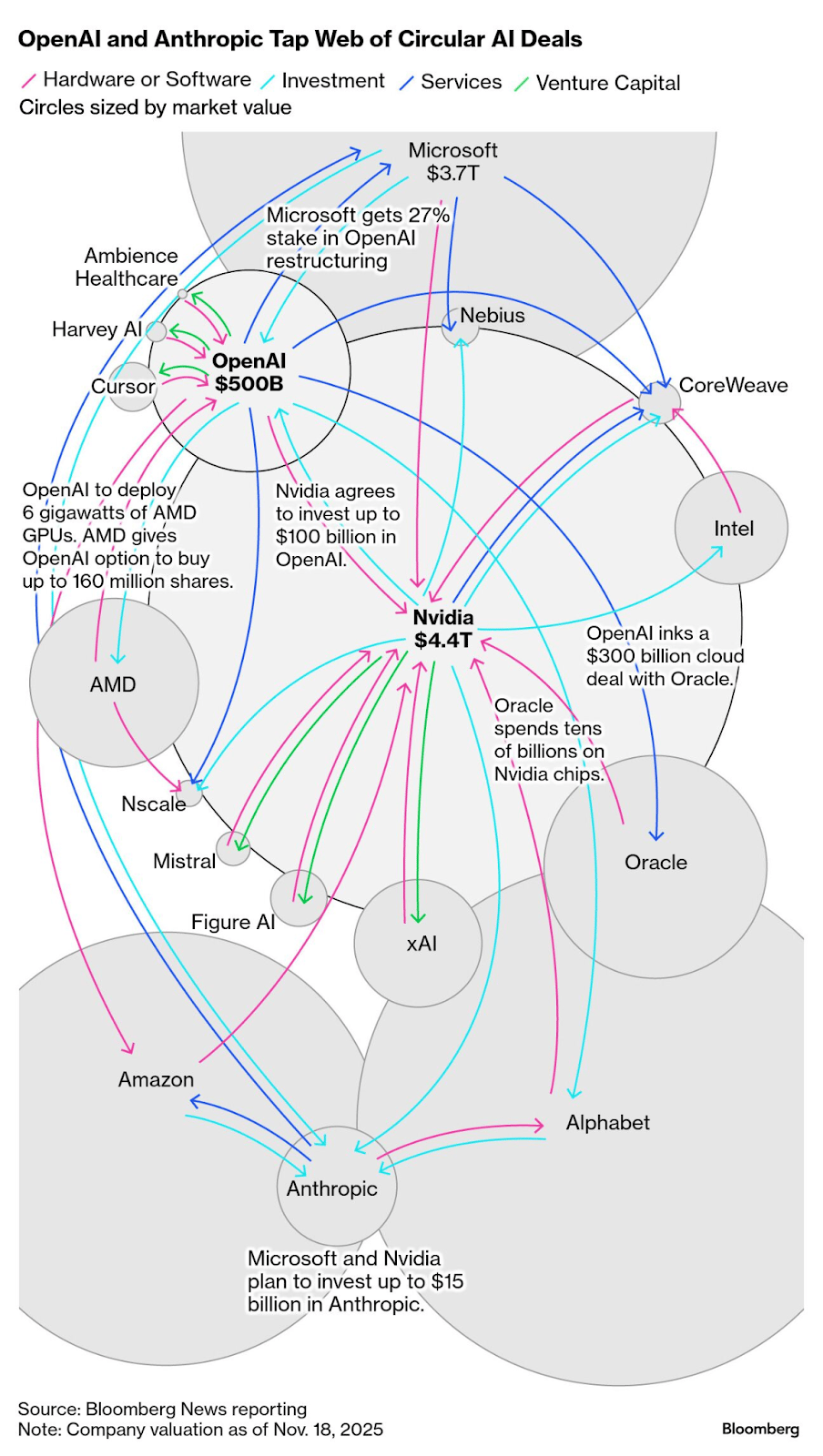

This edition of the newsletter investigates the "Circular Financing" phenomenon—a complex web of vendor financing and round-trip revenue that Goldman Sachs estimates may now underpin up to $400 billion of the AI economy. We explore why famous bears like Michael Burry are betting against it, why the "Magnificent Seven" are rushing to pivot from chatbots to "Agentic AI" to save the narrative, and what this means for your portfolio in 2026.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

The Mechanism: How to Print Revenue

To understand the anxiety in the market, one must look past the income statements and into the deal structures. In a traditional economy, a company produces a good, and an external customer buys it with money earned from a separate economic activity. In the 2025 AI economy, the lines between investor, customer, and supplier have blurred into a singularity.

The mechanism, often referred to as "round-tripping" by critics or "ecosystem building" by proponents, works like this:

The Injection: A Hyperscaler (e.g., Microsoft, Amazon, Google) invests billions of dollars in a promising AI model startup (e.g., OpenAI, Anthropic).

The Stipulation: This investment is rarely a blank check. It often comes with a contractual requirement—explicit or implicit—that the startup must spend a vast majority of that capital on cloud computing services provided by the investor.

The Round Trip: The startup takes the investor's cash and immediately sends it back to the investor's cloud division to rent GPUs.

The Booking: The Hyperscaler books this returning cash as "Cloud Revenue," boosting its growth metrics and validating the narrative of insatiable AI demand.

This loop is not illegal, but it distorts the true picture of organic market demand. We saw a prime example of this dynamic recently with the revelation regarding the Microsoft-Nvidia-Anthropic triangle. Reports indicate a deal structure where Microsoft and Nvidia invested heavily in Anthropic, which reportedly then ordered $30 billion worth of Azure compute—infrastructure powered, of course, by Nvidia chips.

The result is a closed loop where capital circulates at high velocity, creating the appearance of massive revenue growth for the cloud providers and chipmakers, while the underlying startups have yet to prove they can generate sustainable third-party revenue to service these massive compute bills.

The "Shadow Debt" of CoreWeave

Perhaps the most illustrative case study of 2025 is CoreWeave. Originally a crypto-mining firm, CoreWeave pivoted to become a specialized cloud provider for AI. It has raised billions in debt and equity, largely backed by the collateral of Nvidia chips—chips it purchased from Nvidia, who is also a strategic investor in CoreWeave.

Critics point out that CoreWeave has utilized "delayed draw term loans" (DDTL), a complex debt instrument where the ability to borrow is tied to revenue projections. If a major customer (like OpenAI or Microsoft) were to delay payments, it could trigger technical defaults. This creates a fragile interdependence: Nvidia invests in CoreWeave; CoreWeave buys Nvidia chips (booking revenue for Nvidia); CoreWeave borrows against those chips to buy more chips. If the music stops—if end-user demand for AI software doesn't materialize to pay for that compute—the unwinding of this leverage could be swift and severe.

The Historical Parallel: "Cisco and the Fiber Barons"

Market veterans will recognize this tune. It was the soundtrack of the late 1990s telecom bubble.

In 1999, telecom companies (the "CLECs") were borrowing billions to lay fiber optic cables across the world. Their primary supplier was Cisco. To keep the boom going, Cisco began lending money to its own customers so they could keep buying Cisco routers. When the demand for bandwidth failed to meet the exuberant projections, the telecom companies defaulted, and Cisco's "vendor financing" loan book evaporated. Cisco stock famously lost 80% of its value and, twenty-five years later, has never reclaimed its 2000 peak.

Today, Michael Burry—the famed investor from The Big Short—is drawing this precise parallel. Burry has reportedly opened short positions against Nvidia and Palantir, posting cryptic warnings about the "capex air pocket" that forms when overcapacity meets under-monetization.

The difference this time is the balance sheet quality. Unlike the debt-fueled telecom startups of 2000, today's Hyperscalers are cash fortresses. Microsoft and Google generate tens of billions in free cash flow every quarter. They can afford to incinerate capital on a bad bet in a way that WorldCom could not. However, the valuation risk remains. If $400 billion of AI spending is indeed circular then the price-to-earnings multiples of the tech sector (currently hovering near 29x) are priced for a perfection that does not exist.

The Pivot: Why "Agents" Are the New "Chatbots"

Silicon Valley is acutely aware of this circular trap. They know that for the financing loop to become a sustainable economy, the AI startups must eventually generate real, sticky revenue from enterprise customers who are not tech giants.

This explains the sudden, industry-wide pivot from "Generative AI" (chatbots that write poems) to "Agentic AI" (systems that do work).

The fatigue with chatbots is real. Consumer churn is high; ChatGPT Plus retains about 71% of users after six months which is excellent for a consumer app but insufficient to justify a trillion-dollar infrastructure buildout. Enterprises have been slower to adopt than expected, wary of hallucinations and data privacy.

Enter the "Agent."

Just yesterday, on November 19, Google launched "Antigravity," a dedicated platform for building AI agents. Unlike a chatbot that answers questions, an agent in Antigravity is designed to be an autonomous worker. It can be assigned a task—"update the website inventory based on this spreadsheet and email the supplier"—and it will execute the code, debug its own errors, and confirm completion.

This is not just a product launch; it is a desperate bid for ROI. The industry needs to prove that AI can replace labor, not just search. If AI can be billed as a "digital employee" rather than a software subscription, the addressable market expands from the billions to the trillions.

OpenAI is moving in lockstep. Their new GPT-5.1-Codex-Max model, also released this week, features "agentic coding" capabilities designed to operate across multiple systems without human hand-holding. The goal is to move upstream into high-value enterprise workflows—legal discovery, supply chain management, automated coding—where the revenue is sticky and the margins are high enough to pay off the massive Nvidia tax.

The Macro Backdrop: Tariffs and Gravity

This high-wire act between circular financing and technological breakthrough is happening against a macroeconomic backdrop that is far less forgiving than in 2021.

The "Liberation Day" Aftermath: The markets are still digesting the volatility from the "Liberation Day" tariffs proposed earlier this year. While the courts vacated the most extreme measures in May, the lingering uncertainty has chilled cross-border capital flows and kept inflationary pressure alive. This prevents the Federal Reserve from cutting rates aggressively.

Interest Rates Floor: With the Fed Funds rate stuck in the 3.75%–4.00% range the cost of capital for non-profitable AI startups is punishing. The "free money" era that fueled the SaaS boom is over. This increases the pressure on the circular financing loops; if startups can't raise cheap equity, they are forced to rely even more on vendor financing from their cloud patrons.

Energy Reality: Even if the financing holds, the physics might not. The International Energy Agency projects data center electricity demand will double by 2030. We are already seeing "speed-to-power" bottlenecks where chips are delivered but cannot be turned on due to grid constraints. This physical limit acts as a hard cap on how fast the AI economy can actually grow, regardless of how much money is thrown at it.

The Great Compression

So, is it a bubble?

The answer is nuanced. We are likely witnessing a "Rational Bubble" in infrastructure—where the assets being built (data centers, power plants, fiber) have long-term value even if the current business models utilizing them fail. However, the valuations attached to the software layer are increasingly detached from reality.

We are entering a period of "Great Compression."

Compression of Margins: As the circular subsidies dry up, AI startups will be forced to compete on price, driving down software margins.

Compression of Multiples: The market will eventually stop valuing "round-trip" revenue at 30x multiples.

What to Watch in 2026: Keep a close eye on the "Revenue Quality" of the Hyperscalers. In upcoming earnings calls, look for disclosures regarding "related party transactions" or revenue derived from investee companies. If the percentage of growth driven by circular deals starts to rise, it may be time to heed Michael Burry's warnings.

However, do not bet against the technology itself. The pivot to Agentic AI is the correct strategic move. If Google's Antigravity or OpenAI's agents can successfully automate 10% of white-collar work, the $400 billion infrastructure bet will pay off in spades. The race is no longer about who has the fastest chip; it is about who can turn that chip into a billable hour of work before the credit cycle turns.