In the end, you can't fool cash flow.

Financial statements are the language of business, but while the Income Statement tells a compelling story about profitability, the Cash Flow Statement reveals the unvarnished truth about a company's financial health. You have to remember that profit is negotiable; cash is not. This statement shows exactly how cash moves in and out of a company, providing a vital check on its liquidity, solvency, and operational efficiency.

It answers critical questions that every investor should ask:

Is the company's core business actually generating cash?

How is it funding its growth—through its own operations or by taking on debt?

Can it afford to pay its bills, invest in the future, and reward shareholders?

200+ AI Side Hustles to Start Right Now

AI isn't just changing business—it's creating entirely new income opportunities. The Hustle's guide features 200+ ways to make money with AI, from beginner-friendly gigs to advanced ventures. Each comes with realistic income projections and resource requirements. Join 1.5M professionals getting daily insights on emerging tech and business opportunities.

The Three Pillars of Cash Flow

A cash flow statement is logically structured into three main activities. Understanding each one is key to decoding the full story.

Cash Flow from Operating Activities (CFO)

This is the heart of the cash flow statement. It reflects the cash generated from a company's primary business activities, such as selling goods or providing services. A consistently positive CFO is a sign of a healthy, self-sustaining business. It adjusts net income (from the income statement) for non-cash items like depreciation and changes in working capital (e.g., accounts receivable, inventory). This section of the statement answers the key question: is the company’s core business truly generating cash?

Cash Flow from Investing Activities (CFI)

This section tracks cash used for or generated from a company's investments. It typically involves the purchase or sale of long-term assets. A negative CFI is often a good sign for a growing company, as it indicates investment in its future through capital expenditures (CapEx) like buying new machinery or facilities. Conversely, a positive CFI could mean the company is selling assets to raise cash. This section of the statement answers the key question: Is the company reinvesting for future growth?

Cash Flow from Financing Activities (CFF)

This section shows the flow of cash between a company, its owners, and its creditors. It includes activities like issuing or repurchasing stock, paying dividends, and borrowing or repaying debt. This section reveals how a company is capitalized and whether it is returning value to its shareholders or taking on more leverage.

To see how this works, let's look at a simplified cash flow statement for the past year for our fictional company, “Apex Innovations”:

Apex Innovations - Statement of Cash Flows | |

Cash Flow from Operating Activities (CFO) | |

Net Income | $135,000 |

Adjustments: | |

Depreciation | $50,000 |

Increase in Accounts Receivable | ($20,000) |

Net Cash from Operations | $165,000 |

Cash Flow from Investing Activities (CFI) | |

Purchase of New Equipment (CapEx) | ($100,000) |

Net Cash from Investing | ($100,000) |

Cash Flow from Financing Activities (CFF) | |

Proceeds from Bank Loan | $40,000 |

Payment of Dividends | ($25,000) |

Net Cash from Financing | $15,000 |

Net Increase in Cash | $80,000 |

Beginning Cash Balance | $50,000 |

Ending Cash Balance | $130,000 |

Analysis:

Healthy Operations: Apex Innovations generated a strong $165,000 in cash from its core business.

Investing for Growth: It spent $100,000 on new equipment, a sign of reinvestment.

Balanced Financing: It took on a $40,000 loan for expansion while still returning $25,000 to shareholders as dividends.

Overall: The company increased its cash position by a healthy $80,000.

What should a YAINer look for:

Beyond analyzing each section individually, investors use the cash flow statement to calculate crucial financial metrics and ratios to identify potential opportunities or warning signs.

The ultimate metric: Free Cash Flow (FCF)

Perhaps the most important metric derived from the cash flow statement is Free Cash Flow. This isn't listed on the statement, but it's the first thing a savvy investor calculates. While there are different variations, a common calculation is:

FCF = Cash Flow from Operations (CFO) - Capital Expenditures (CapEx)

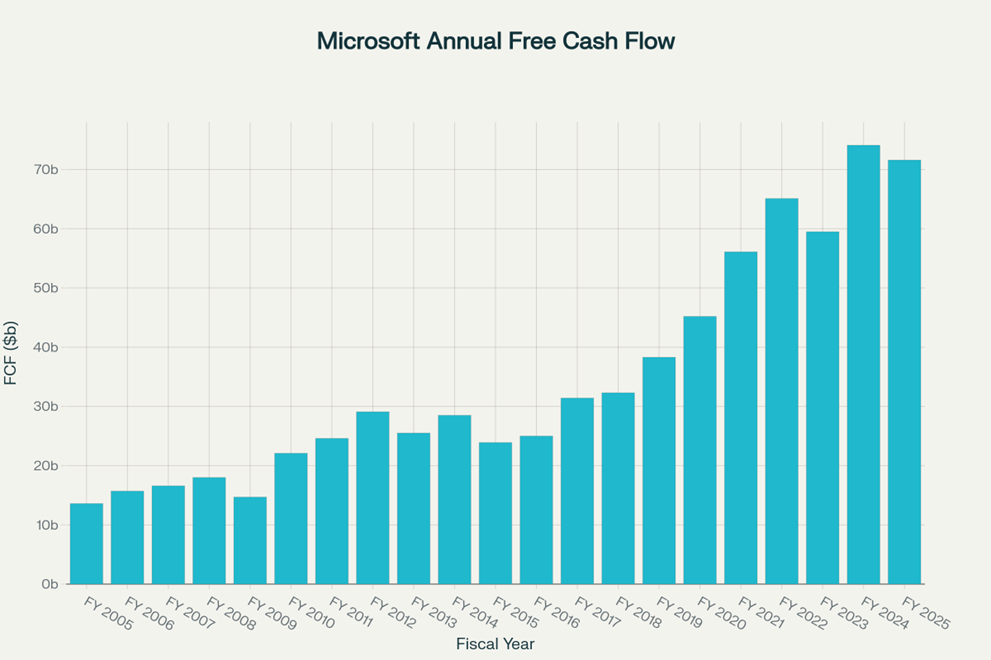

Free cash flow represents the cash a company has left over after paying for its operating expenses and capital expenditures. This is the cash that is available to repay debt, pay dividends, repurchase shares, and fund further growth. A strong and growing FCF is a powerful indicator of a company's financial strength and its ability to generate shareholder value.

if we apply the formula to our example:

Apex Innovations' FCF = $165,000 - $100,000 = $65,000

which means that after running the business and investing heavily in its future, Apex generated $65,000 in free cash. This easily covers its $25,000 dividend payment and is a powerful sign of financial strength.

However, investors rarely look at a single cash flow statement in isolation. They analyze trends over multiple periods (quarterly and annually) to identify patterns and assess the sustainability of the company's performance. Essentially, consistent FCF generation signals a robust, high-quality business with the fuel to reward its owners.

Microsoft Free Cash Flow (FY 2005-2025)

Free cash flow yield (FCF yield)

Free cash flow yield (FCF yield) is a financial ratio that compares a company’s free cash flow to its market value, serving as a key metric for investors to assess how efficiently a company generates cash relative to its stock price or market capitalization.

FCF Yield = Free Cash Flow / Market Capitalization

if we go back to our example and Apex Innovations has a market capitalization of $600,000:

Apex Innovations' FCF Yield = $65,000 / $600,000 = 10.83%

A high FCF Yield can suggest that a company is undervalued relative to the amount of cash it produces. Investors often look for companies with high FCF yields as potential investment opportunities.

However, the real power of FCF Yield comes from comparison. An investor would want to compare a free cash flow yield to:

Its own historical FCF Yield: Is it improving or declining over time?

Competitors in the same industry: How does it stack up against other major players?

The broader market: How does it compare to the average FCF Yield of the S&P 500 or relevant index?

Other investment options: Is the FCF Yield more attractive than the yield on corporate bonds or government securities?

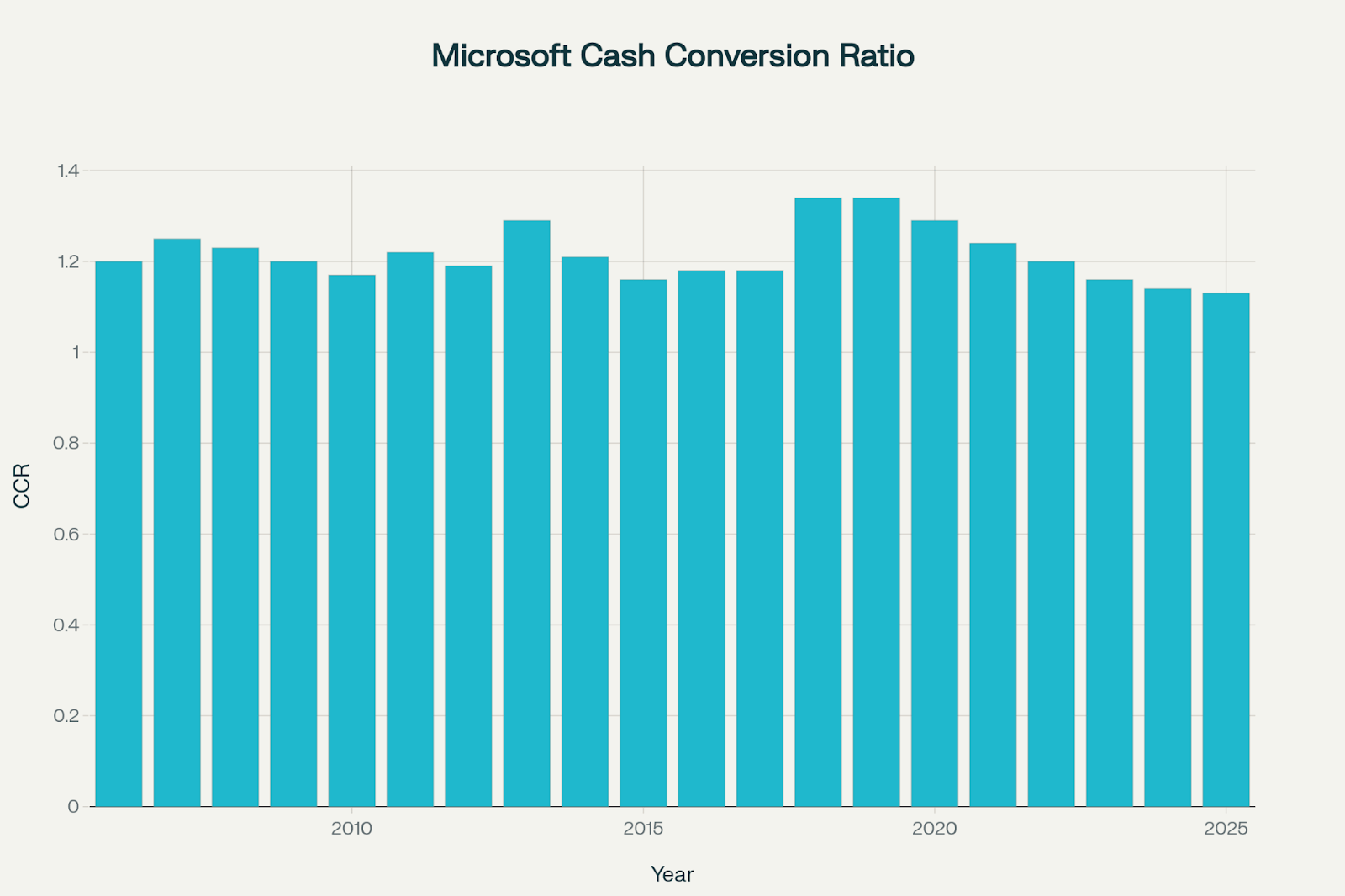

The Cash Conversion Ratio (CCR)

One of the most powerful ways to analyze cash flow is by measuring the quality of a company's earnings. The Cash Conversion Ratio (CCR) does exactly that by comparing the cash generated from operations to the reported net income. CCR reveals how efficiently a company converts its accounting profit into actual cash. A high ratio suggests strong earnings quality and efficient working capital management.

The formula is simple:

CCR = Cash Flow from Operations (CFO) / Net Income

A CCR greater than 1.0 is generally considered healthy. It means that for every dollar of profit reported, the company generated more than one dollar in cash. A ratio consistently below 1.0 can be a red flag, suggesting that reported profits aren't translating into cash, possibly due to aggressive accounting or poor collections. Going back to our example:

Apex Innovations' CCR = $165,000 / $135,000 = 1.22

A CCR of 1.22 is an exceptional result. It means for every dollar of profit Apex reported, it generated $1.22 in actual cash—a hallmark of high-quality earnings and efficient management.

More cash than profit? Is that possible? Yes! The most common reason being that the company’s customers pay up more quickly than the company pays its suppliers.

Microsoft Cash Conversion Ratio (CCR) 2006-2025

Why Cash Flow is King for Investors

Liquidity Check: The statement shows if a company can cover its short-term liabilities. Cash is what pays the bills, not profit.

Validates Earnings: Strong operating cash flow confirms that the profits reported on the income statement are real and sustainable.

Dividend Sustainability: Dividends are paid from cash. The CFF section shows if dividend payments are comfortably covered or if they rely on debt.

Funding Growth: It reveals whether a company can fund its capital expenditures from its own cash (a sign of strength) or if it must constantly seek external financing.

By analyzing the trends in all three sections and calculating key ratios like the CCR, you can build a comprehensive picture of a company's financial resilience and long-term value-creation potential. It's a crucial step beyond the income statement to understand what’s truly happening under the hood.

Warning Signs to Heed

Investors are always on the lookout for red flags in the cash flow statement that could signal underlying problems. These include:

Negative Cash Flow from Operations: A persistent inability to generate positive cash from core operations is a major concern.

Cash Flow Consistently Lagging Net Income: This could indicate issues with earnings quality.

Heavy Reliance on Financing Activities for Cash: A company that consistently needs to raise new debt or equity to fund its operations may not have a sustainable business model.

Large and Erratic Swings in Cash Flow: Volatility in cash flows can make it difficult to assess a company's financial stability.

Declining Free Cash Flow: A downward trend in FCF can be a sign of deteriorating financial health.

In conclusion, the cash flow statement is a vital tool for investors to look beyond the reported earnings and understand the true cash-generating ability of a business. By carefully dissecting its components, analyzing key metrics, and identifying trends and red flags, investors can make more informed decisions about where to allocate their capital.

In investing, cash flow isn’t just king — it’s the truth behind the numbers!