You are rich if and only if money you refuse tastes better than money you accept

If you look at the graveyard of financial history—from the Vanderbilts to the lottery winners of the 1990s—you will notice a recurring pattern. The skills required to make money are not the same skills required to keep it. And neither of those guarantees the ability to actually enjoy it.

In finance, we often obsess over the "Get Rich" phase. We spend hours analyzing the free cash flow of a small-cap software firm (like our recent look at Cerillion) or worrying about the yield curve control in Japan (the "Sanae Shock"). We treat wealth as a single mountain to climb.

But wealth is not one mountain. It is a ridge traverse across three very different peaks, each with its own weather system, terrain, and required equipment.

Morgan Housel famously popularized the idea that "getting rich and staying rich are different skills." It is a brilliant observation, but I would argue it is incomplete. There is a third skill, often ignored until the ledger is already closed: Living rich.

Today, we are going to break down the anatomy of these three phases. We will look at why high-conviction concentration builds wealth, why paranoid diversification preserves it, and why the ability to refuse money is the ultimate metric of success.

Better prompts. Better AI output.

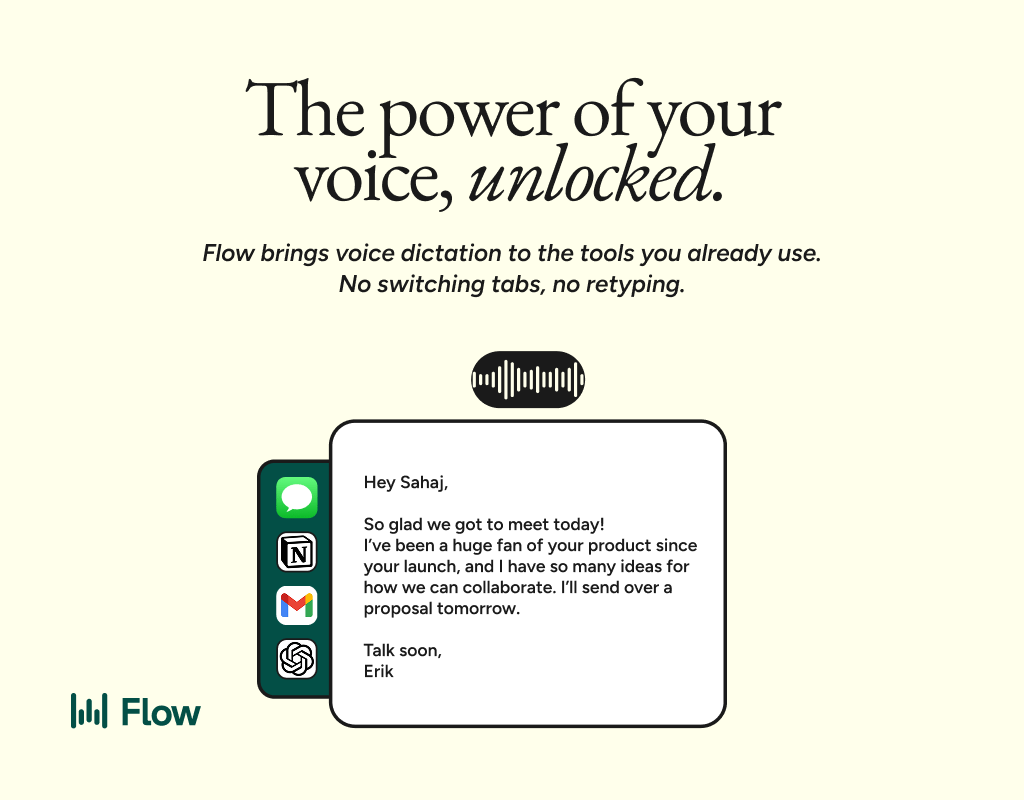

AI gets smarter when your input is complete. Wispr Flow helps you think out loud and capture full context by voice, then turns that speech into a clean, structured prompt you can paste into ChatGPT, Claude, or any assistant. No more chopping up thoughts into typed paragraphs. Preserve constraints, examples, edge cases, and tone by speaking them once. The result is faster iteration, more precise outputs, and less time re-prompting. Try Wispr Flow for AI or see a 30-second demo.

Phase 1: Get Rich (The Art of Asymmetry)

Let’s be honest about the mechanics of "Getting Rich." You do not get wealthy by diversifying into the S&P 500 and waiting 40 years. That gets you comfortable. That gets you retired. But it does not generate step-change wealth in a condensed timeframe.

To change your financial bracket, you need concentration, leverage, or asymmetry.

The Concentration Paradox

In our analysis of specific equities, we often look for companies with deep moats and high recurring revenue. But the investors who make outsized returns are those who bet heavily when the market is wrong.

Consider the risk profile of a founder. A founder is the ultimate concentrated investor. They have 100% of their human capital and often 100% of their financial capital in one asset. If it works, they get rich. If it fails, they go to zero.

As public market investors, we cannot (and should not) fully replicate that level of risk. However, the "Get Rich" phase demands a departure from the "60/40" safety net. It requires identifying an asymmetry—a scenario where the upside is multiples of the downside—and sizing the position large enough to matter.

The math is brutal but simple: If you hold 50 stocks and your best idea doubles, your portfolio is up 2%. That is noise. If you hold 5 stocks and your best idea doubles, your portfolio is up 20%. That is wealth generation.

Note: This is not a prescription for recklessness. Concentrated bets require a specific temperament and the ability to absorb volatility. If you cannot sleep when your portfolio is down 30%, you are not equipped for Phase 1 concentration.

Beyond Equities

It is worth noting that for many YAIN readers, the "Get Rich" asymmetry doesn't come from the stock market at all. It comes from career leverage. It comes from equity in your own business, or a structured trade where you have capped downside. The vehicle changes, but the engine is the same: Ownership. You cannot get rich renting out your time; you must own a piece of the upside.

Most corporate jobs would like you to believe the exact opposite: be a good soldier and one day you will be fine. That social promise is broken, and one needs to wake up and realise that the only path to wealth generation is through ownership and equity, not a 9-to-5 job, even at JP Morgan. The same very educated students who would laugh at a kid dreaming to become the next Cristiano Ronaldo relentlessly apply to McKinsey. However the math is brutal here: McKinsey receives more than 1 million applications per year, with approximately 1% acceptance rate and only 1.5 out 100 associates make it to partner; that’s a combined 0.015% probability. In comparison, Gemini estimates 0.04% the chance of becoming a professional football player: maybe the kid mastering his trivela skill had a point here.

The Trap: The skill set here is optimism and conviction. You have to believe the world will look different in five years. But this optimism is a double-edged sword. The same aggression that builds the pile is the biggest threat to the pile in Phase 2.

Phase 2: Stay Rich (The Art of Paranoia)

If "Getting Rich" requires being an optimist, "Staying Rich" requires becoming a pessimist.

The history of markets is littered with traders who made $10 million in a bull run and gave $11 million back in the crash. Why? Because they didn't switch gears. They applied Phase 1 leverage to a Phase 2 portfolio.

Staying rich is about survival. It is about recognizing that the "tail events"—the 3-sigma moves like the Great Financial Crisis, the COVID crash, or a sudden spike in Japanese bond yields—are not anomalies. They are inevitable features of the system.

The Barbell Strategy

The most practical way to operationalize Phase 2 is the "Barbell" approach. You keep your "Get Rich" engine running on one side (highly volatile, high growth), but you counter-balance it with a "Stay Rich" bucket that is boring, unsexy, and safe.

This is where the content we discussed in our "Duration Trap" macro piece becomes vital. If your "Get Rich" assets are long-duration tech stocks, your "Stay Rich" assets cannot be long-duration bonds that crash at the same time (as we saw in 2022). You need true uncorrelation:, short-term treasuries, cash buffers, equity strongholds, like consumer-staples.

The Mathematics of Zero

The most important number in finance is zero. If you multiply any number by zero, you get zero. It doesn't matter how high your CAGR (Compound Annual Growth Rate) was for the last decade; if you blow up in Year 11, the geometric return is zero.

Preserving wealth requires shifting your focus from "Return on Capital" to "Return of Capital."

Think of the "Sanae Shock" scenario we discussed last week. If you are fully invested in high-beta tech stocks and the cost of capital spikes globally because Tokyo loses control of its yield curve, you get crushed. But if you have a portion of your wealth in assets that are uncorrelated to the equity risk premium, you survive to buy the wreckage.

The Trap: The hardest part of Phase 2 is FOMO (Fear Of Missing Out). When the market is ripping higher and your prudent, diversified "Stay Rich" portfolio is lagging the Nasdaq by 15%, you will feel like an idiot. You will be tempted to go back to Phase 1 behavior.

Resist it. The goal of Phase 2 is not to beat the benchmark every year. The goal is to never be forced to sell at the bottom..

Phase 3: Live Rich (The Art of Sufficiently)

This is the phase that financial newsletters rarely discuss, perhaps because it cannot be quantified in a DCF model. But it is the most critical. It is the "YAIN Framework" for closing the loop.

"Living Rich" has nothing to do with the number on the screen. We all know the stories of the investment banker who makes $5 million a year but is miserable, divorced, and stressed because his expenses are $5.1 million.

Living Rich is about autonomy and sufficiency.

The Gap Between Ego and Reality

Wealth is relative. If your net worth doubles, but your desire for status triples, you have actually become poorer. The goalpost has moved faster than the ball.

The "Live Rich" phase is about decoupling your spending from your ego. It is realizing that the utility of money diminishes rapidly once your basic needs and a few comforts are met. The greatest dividend money pays is not a Ferrari; it is the ability to wake up in the morning and say, "I can do whatever I want today."

The YAIN Framework for Living Rich

How do we operationalize this? Here are three concrete steps:

Define "Enough" with a Ratio: Don't pick an arbitrary number like "$10 million." Pick a ratio. "Enough" is when your safe withdrawal rate covers your desired lifestyle with a 20% margin of safety. Once you hit that, every extra dollar should be treated differently—it’s for charity, for risk-taking, or for legacy, but not for buying more happiness.

Hack the Hedonic Treadmill: Psychological research is clear: we adapt to durable goods quickly. The big house feels normal after three months. But we don't adapt as quickly to experiences. You remember the trip to Patagonia for thirty years. Shift your capital allocation from "Things" to "Memories."

Use Wealth to Remove Negatives: Buying happiness is hard. Buying your way out of misery is easy. The highest ROI usage of cash in Phase 3 is "unsexy" friction removal. Pay for the accountant so you don't stress about taxes. Pay for the cleaner. Move closer to work to kill the commute. If you are rich but still doing tasks you hate, you are failing Phase 3.

The Cycle

The danger is thinking these phases are linear. You don't just Get Rich, then Stay Rich, then Live Rich. You are constantly cycling through them.

You might have a "Get Rich" bucket of capital (your business, your high-conviction stocks) and a "Stay Rich" bucket (your home, your bonds, your cash). And every day, you must make "Live Rich" decisions.

At YAIN, we spend a lot of time analyzing the markets to help you with Phase 1 and Phase 2. We dig into the balance sheets of companies like Cerillion so you can compound capital. We watch the macro tides so you don't get washed away.

But Phase 3? That’s on you.

The ultimate tragedy is to win the game of money but lose the game of life. To ace Phase 1, survive Phase 2, and fail Phase 3.

Get rich by taking risks. Stay rich by managing risks. Live rich by realizing that money is just fuel, not the destination.